A Turning Point in the Dutch Housing Market

Over the past 18 months, the Dutch housing market faced a correction after a decade of stable growth. This cooling trend is largely attributed to increased mortgage interest rates and inflation. However, recent publications from NVM and Central Bureau of Statistics (“CBS”) indicate a turning point. Average home transaction prices increased in Q2 2023 compared to Q1. The shift is driven by multiple factors, including stabilising mortgage interest rates, record wage increases, and ongoing challenges in the construction sector.

Rising interest rates cause housing market slowdown

In response to the high inflation that emerged after COVID, the European Central Bank (ECB) has been raising its official interest rates since 2022. As a result, homebuyers found themselves faced with reduced affordability as higher interest rates led to diminished borrowing potential. Consequently, the demand for homes decreased, leading to a housing market slowdown. This decline was also influenced by uncertainties surrounding the broader economic landscape.

As of mid-2023, the Hypotheker (the leading Dutch mortgage intermediary chain) reported that interest rates have stabilised in the first half of 2023, and are expected to decline towards the end of the year.

Housing market on the rebound in 2023

The Dutch housing market is showing signs of renewed strength. The NVM, the Dutch real estate broker association (whose data typically precedes official figures from CBS), reported a median sale price of €410,000 in Q2 2023. This marks a modest 2.8% increase compared to Q1 (Figure 1). Realtors sold more than 34,000 pre-existing homes, a 20% jump from Q1 2023 (Figure 2). Furthermore, listings increased by 29% compared to the previous quarter.

This trend has more recently been substantiated by CBS, who reported a month-on-month increase in the housing market index from June to July 2023 of 0.5%. While the year-on-year index development is down 5.5%, the month-on-month uptick indicates that a turning point in the housing market might have been reached.

As Lana Gerssen from NVM emphasises, dynamism is returning in the housing market, beneficial for both buyers and sellers. With economic stability and wage growth, buyers are seizing more opportunities and growing in confidence, while homes across all price ranges are selling more swiftly.

The optimistic outlook is driven by consistent wage increases across various sectors. The CBS reports that collectively negotiated wages have increased with 5,7% in the second quarter of 2023 – the largest increase of the past 40 years. With rising incomes, many potential homebuyers now find themselves in a more favorable position to delve into the housing market, thereby increasing demand. This is particulary true for those who were previously sidelined due to affordability challenges during the period of spiking interest rates.

However, ABN AMRO indicates that home affordability remains only moderate. The ratio of net housing costs to net incomes is notably higher than historical averages. Some of the market corrections required for better affordability might come indirectly via wage growth.

Limited construction output continues to strain supply

Despite these encouraging indicators, the housing market still faces challenges, especially on the supply side. The construction sector’s underperformance has been a critical factor in the persistent housing shortage. The sluggish rate of new housing projects has failed to keep up with rising demand. In addition, the Economic Institute for Construction (EIB) anticipates that the pace of home construction will decrease even more sharply than initially projected. According to EIB estimates, there will be a 6.5% reduction in homes built this year, a significant drop from their previous 3.5% prediction. Finally, the unstable political environment, especially after the recent government’s downfall, has brought about policy uncertainties that deter decision-making and sector investments.

The Impact of Rising Wages on Dutch Housing Market

Much has been said about the effect of increased mortgage interest rates and (the lack of) construction on house prices in the Netherlands. Years of accommodative monetary policy and a growing housing shortage have fueled a trend of double digit growth. The growth has cooled off following the interest rate hikes in 2022, and the market is facing a correction as shown by the CBS housing market index.

In a housing market with severe shortages, price growth is driven by demand. The lack of available housing have aligned affordability and borrowing capacity. Homebuyers buy the house they can afford. Borrowing capacity is determined by a couple of factors; interest rates, household income, regulations (e.g., maximum Loan-to-Income ratio) and, to a lesser extent, savings.

Over recent years, decreasing interest rates have pushed up the borrowing capacity and therefore prices. Looking forward, we believe household income can take over as a driver of growth .

Labour unions, facing a historically tight labour market, have pushed for record wage increases (often exceeding 10%) to protect the purchasing power of their members. After a year of peak inflation, inflation is expected to stabilise to approximately 5% for the next 2 years. Factoring in expected inflation only, stable real wages would result in a 36% increase in nominal wages.

The underneath graph takes the nominal wage increases forward. It adds the impact of newly introduced regulations on borrowing capacity, as well as a 1% range around current interest rates.

After two decades of near-zero interest rates, inflation considerations need to make their way back into investor’s portfolios. At Someday, we believe it is the loop from generic inflation to Real Estate appreciation, that can reinstate Real Estate as the inflation asset it once was in asset allocations.

When leveraged home ownership increases macro-economic volatility

The Netherlands is a country of homeowners. With one of the highest percentage of homeownership in Europe (70%) and growing house prices, Dutch households have done well over recent years. After all, home ownership is an integral part of sound financial planning: Households forcibly set money aside, it is interesting from a fiscal perspective and quite frankly the only way for households to get access to significant leverage.

In a linear world without surprises, buying your family house with a mortgage is a great investment. But let’s not forget that our world is non-linear, your Real Estate investment is not liquid, most of the times highly leveraged and prone to specific risk.

“The average personal investor sits on a non-traded, highly leveraged, illiquid asset chockfull of idiosyncratic risk – the owner-occupied home.”1

Issues arise when life is not linear. In an economic downturn, the stars can align negatively for the homeowner. If house prices and employment plummet simultaneously, the combination of leverage and short-term lack of liquidity can be disastrous for the unemployed homeowner.

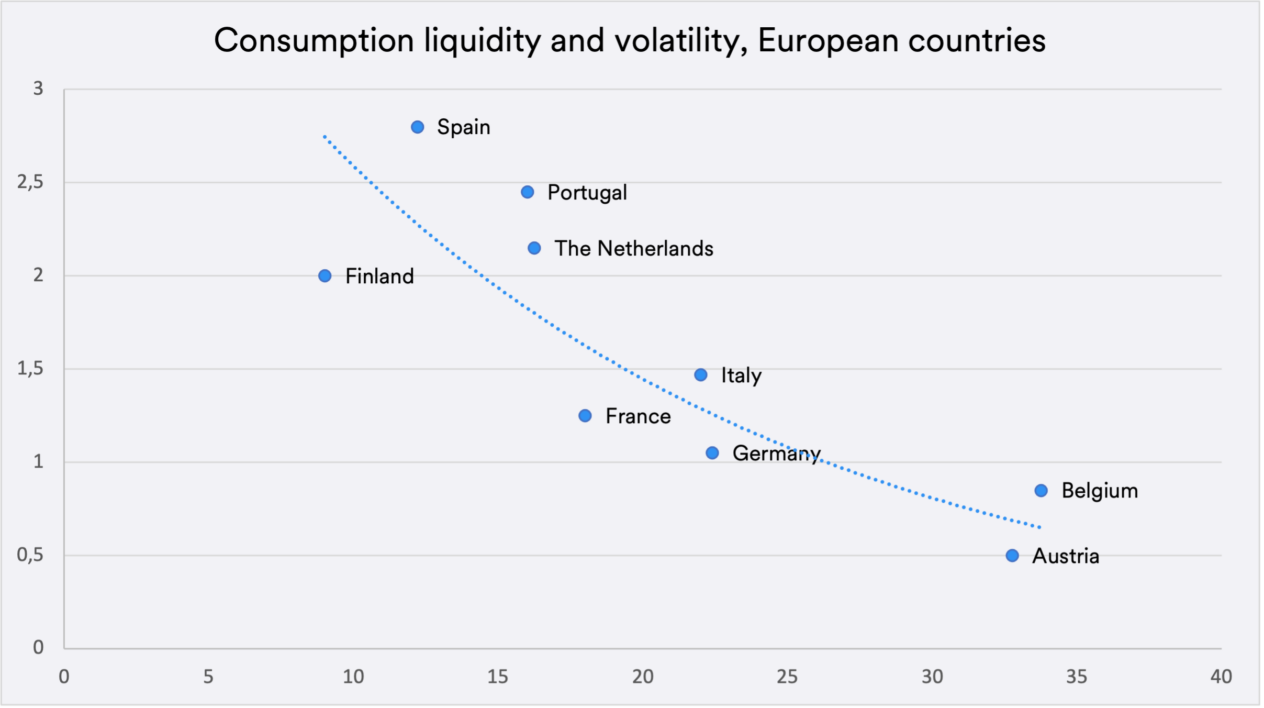

Taking a helicopter view, this could almost have the effect of a self-fulfilling prophecy: When many consumers can structurally not access liquidity in times of need, national consumption will be reduced, yet again impacting the economy negatively. The figure below shows that economies where households have least access to liquidity will be more volatile.

Source: CPB

At Someday, we believe that bringing flexibility back into the system helps both individual investors and society at large. We want to help consumers by giving them the option to adapt their leverage of access liquidity when they need.

1 Portfolios for Long-Term Investors” Review of Finance Volume 26, Issue 1.